Pvm Accounting Fundamentals Explained

Pvm Accounting Fundamentals Explained

Blog Article

The Main Principles Of Pvm Accounting

Table of ContentsThe 20-Second Trick For Pvm AccountingIndicators on Pvm Accounting You Should KnowHow Pvm Accounting can Save You Time, Stress, and Money.9 Easy Facts About Pvm Accounting ExplainedFascination About Pvm AccountingA Biased View of Pvm Accounting

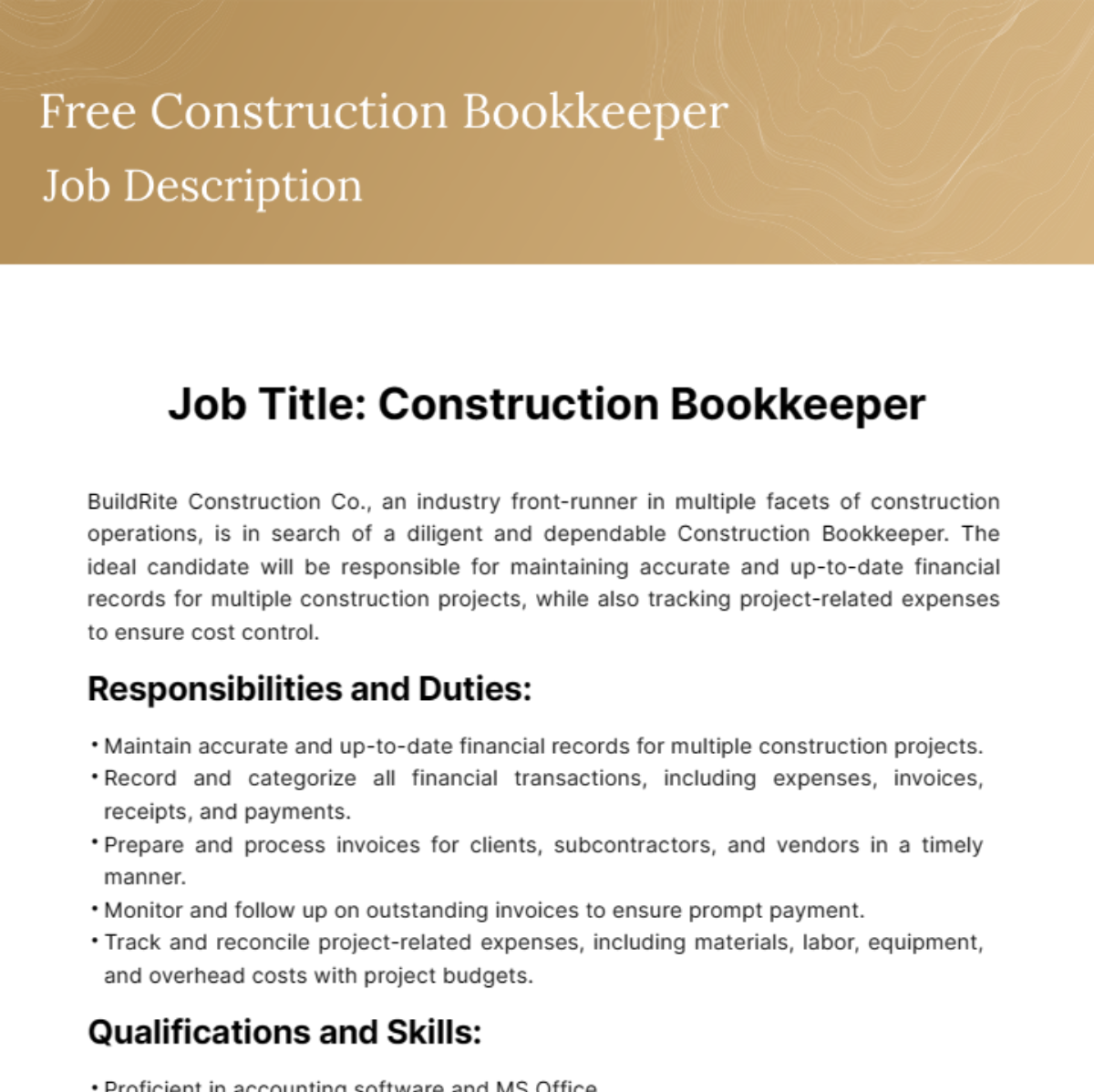

Make sure that the audit process abides with the law. Apply needed construction bookkeeping requirements and treatments to the recording and reporting of building task.Understand and keep conventional price codes in the bookkeeping system. Connect with numerous financing agencies (i.e. Title Firm, Escrow Company) concerning the pay application procedure and demands needed for payment. Handle lien waiver disbursement and collection - https://www.intensedebate.com/profiles/leonelcenteno. Screen and settle bank issues including fee abnormalities and examine distinctions. Assist with executing and preserving inner economic controls and treatments.

The above declarations are meant to describe the general nature and level of job being executed by individuals assigned to this classification. They are not to be construed as an extensive checklist of responsibilities, responsibilities, and skills called for. Employees might be called for to perform duties beyond their typical obligations every now and then, as required.

How Pvm Accounting can Save You Time, Stress, and Money.

Accel is seeking a Building Accounting professional for the Chicago Office. The Building Accounting professional performs a variety of accountancy, insurance compliance, and job management.

Principal obligations include, however are not limited to, taking care of all accounting features of the firm in a timely and accurate way and supplying records and schedules to the company's CPA Firm in the prep work of all economic declarations. Guarantees that all accountancy treatments and features are taken care of accurately. Responsible for all financial records, payroll, financial and daily operation of the accountancy feature.

Prepares bi-weekly trial balance records. Works with Task Managers to prepare and publish all monthly billings. Procedures and problems all accounts payable and subcontractor payments. Creates regular monthly wrap-ups for Workers Payment and General Obligation insurance policy costs. Generates regular monthly Job Expense to Date records and collaborating with PMs to fix up with Task Supervisors' allocate each job.

Getting My Pvm Accounting To Work

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Workplace) and Procore construction monitoring software a plus. https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Must additionally be efficient in other computer system software systems for the preparation of records, spreadsheets and other audit analysis that might be called for by administration. construction taxes. Must possess solid business skills and capability to focus on

They are the economic custodians that ensure that building tasks remain on budget plan, follow tax obligation regulations, and preserve economic openness. Construction accountants are not just number crunchers; they are calculated companions in the construction process. Their primary function is to handle the economic facets of construction projects, guaranteeing that resources are designated successfully and economic threats are decreased.

Not known Facts About Pvm Accounting

By preserving a tight hold on project financial resources, accounting professionals aid protect against overspending and economic obstacles. Budgeting is a foundation of effective building projects, and building and construction accounting professionals are critical in this regard.

Browsing the complex internet of tax obligation policies in the building and construction market can be challenging. Building accountants are well-versed in these guidelines and guarantee that the task complies with all tax obligation demands. This consists of managing pay-roll taxes, sales taxes, and any various other tax obligation responsibilities details to building. To succeed in the duty of a building and construction accountant, individuals need a strong educational foundation in accountancy and finance.

Furthermore, accreditations such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Professional (CCIFP) are very related to in the market. Building projects frequently involve tight due dates, changing laws, and unanticipated costs.

Unknown Facts About Pvm Accounting

Professional certifications like CPA or CCIFP are likewise highly recommended to show proficiency in construction bookkeeping. Ans: Building accountants create and monitor spending plans, recognizing cost-saving chances and making sure that the job stays within spending plan. They additionally track costs and forecast financial demands to stop overspending. Ans: Yes, building accountants take care of tax obligation conformity for building projects.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make challenging selections amongst numerous economic options, like bidding process on one job over another, choosing funding for materials or devices, or like it establishing a project's profit margin. Building is an infamously volatile market with a high failing price, sluggish time to repayment, and irregular cash flow.

Common manufacturerConstruction company Process-based. Manufacturing includes repeated procedures with easily recognizable expenses. Project-based. Manufacturing needs different procedures, materials, and devices with varying expenses. Repaired area. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated places. Decentralized. Each task takes location in a brand-new location with differing site problems and unique difficulties.

Indicators on Pvm Accounting You Should Know

Frequent use of different specialty contractors and providers impacts performance and money circulation. Payment arrives in full or with regular repayments for the complete contract quantity. Some section of repayment might be kept up until project conclusion even when the service provider's job is ended up.

Regular manufacturing and short-term contracts result in workable cash money circulation cycles. Uneven. Retainage, sluggish repayments, and high ahead of time costs cause long, uneven cash flow cycles - construction accounting. While conventional producers have the advantage of regulated atmospheres and optimized manufacturing procedures, construction firms must constantly adapt to each brand-new task. Also somewhat repeatable projects require adjustments due to site conditions and various other factors.

Report this page